后疫情时代,协作机器人能否经历第二次增长潮?

http://www.gkong.com 2023-05-19 17:20 《中华工控网》翻译

Can the Collaborative Robot Market Experience a Second Growth Surge in the Post-pandemic Era?

后疫情时代,协作机器人能否经历第二次增长潮?

The market for collaborative robots is forecast to show strong growth over the coming years, with rising sales in industrial and non-industrial sectors and new application scenarios being developed.

协作机器人市场预计在未来几年将呈现强劲增长,工业和非工业领域的销售额不断上涨,并且正在开发新的应用场景。

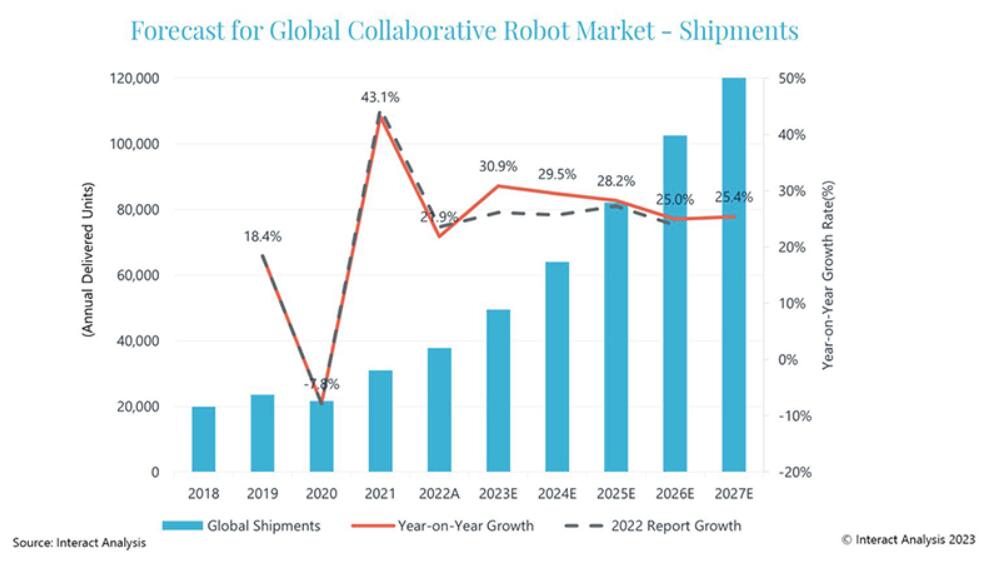

According to Interact Analysis’ newly published ‘Global Collaborative Robot Market–2023’ report, market revenue grew by 17.2% to US$954m in 2022, with shipments increasing by 21.9% to 37,780 units. Following a rapid rebound in 2021 in the wake of the Covid-19 pandemic, the growth rate of the collaborative robot (cobot) market dropped to around 20%. Can collaborative robots return to the previous high-speed growth rate of over 30% within the next 5 years? Where does the growth point for a second surge in shipments come from?

根据Interact Analysis新发布的《2023年全球协作机器人市场》报告,2022年全球协作机器人市场规模增长17.2%至9.54亿美金,出货量增长21.9%至37780台。在2021年疫情期间,协作机器人迅猛反弹之后增速回落至20%上下。未来5年,协作机器人还能重回30%+的高速增长区间吗?二次爆发的增长点来自何处?

We will analyze the potential for rapid growth in the collaborative robot market from five perspectives: market, product, industry, application and customer.

我们将从市场、产品、行业、应用和客户五个角度分析协作机器人市场快速增长的潜力。

Market: Outlook still optimistic in the medium to long term, with price declines slowing

市场:中长期前景依然乐观,价格跌势趋缓

The compound annual growth rate (CAGR) of global collaborative robot market shipments is anticipated to be 27% over the next five years, with China recording a market CAGR of about 30%, and the South America and Southeast Asia regions both exceeding 30% growth annually. As shown in the graph below, the growth rate forecast for the next few years is higher compared with 2022 predictions (gray dashed line).

未来五年全球协作机器人市场出货量复合年增长率(CAGR)预计为27%,其中中国市场约为30%,南美和东南亚地区每年增速均超过30%。如下图所示,未来几年增长率相较于2022版本(灰色虚线)进行了上调。

Unlike the price rebound of traditional industrial robots in 2022, the price of collaborative robots is still declining, but the magnitude of decline is slowing down. The main reasons behind this are:

价格方面,与传统工业机器人价格出现回升不同,协作机器人的价格依旧在下滑,只是下降幅度趋缓。主要原因是:

1.In the Chinese market, which accounts for more than half of all shipments, the price decline trend is still significant. Even though most leading component manufacturers have increased their prices more than once, cobot vendors can still control cost within a reasonable range by using local component brands.

2.Market competition is becoming increasingly fierce and so it is unsurprising that many leading cobot manufacturers are employing low pricing strategies to drive growth, particularly as they approach a critical juncture for financing or potential listing.

3.There have been over a hundred large orders placed in the automotive and non-industrial sectors, driving down average prices.

1.在占全部出货量一半以上的中国市场,价格的下降趋势依旧显著。尽管大多数领先的组件制造商都不止一次地提高了价格,但协作机器人供应商仍然可以通过使用本地组件品牌将成本控制在合理范围内。

2.市场竞争越来越激烈,因此许多领先的协作机器人制造商采用低价策略来推动增长也就屡见不鲜,尤其是在他们接近融资或潜在上市的关键时刻时。

3.汽车和非工业部门出现了超一百台的大订单,拉低了平均价格。

According to our predictions, the trend of price declines for collaborative robots will be relatively shallow in the next 5 years. The increase in the proportion of >10kg models combining with the added value of in-machine vision with AI solutions have offset a significant decline in average market prices. As a result, we predict annual price declines will remain at 3-5%.

根据我们的预测,未来5年协作机器人的价格趋势较为温和。10kg以上大负载产品占比上升,以及机器视觉、AI等功能的增加对冲了市场均价的大幅下滑,我们预测每年价格降幅维持在3%-5%。

Product: Greater intelligence, greater payload, and greater openness

产品:高智能化、高负载化、高开放度

Technologies and solutions related to greater intelligence–including artificial intelligence and machine vision–are increasingly being promoted by collaborative robot manufacturers and are gradually beginning to influence customers’ purchasing decisions. Collaborative robot vendors want to further expand their application scenarios and are looking at ways to increase the perceptive abilities and flexibility of their machines.

以人工智能和机器视觉的代表的智能化技术正越来越多地被协作机器人厂商提及,并逐渐开始影响客户的购买决策。协作机器人想要进一步拓展应用场景,感知能力和灵活度也是协作机器人厂家着力提升的方向。

Demand is growing to expand collaborative robot product lines to carry greater payload, partly from the needs of real applications like palletizing or welding, and also in order to find incremental market growth space. Faced with inevitable competition from SCARA and high-speed small six-axis robots in the small payload sector, many cobot vendors have begun to take advantage of easy deployment, lightweight body, and high cost-effectiveness to develop models with >10kg payload. The chart below presents the payload and arm length of newly launched collaborative robot models from 2022 to 2023, with the growing trend for higher payload and longer arm length clearly visible.

扩展协作机器人产品线以承载更大有效载荷的需求正在增长,部分原因是码垛或焊接等实际应用的需求,另外也是为了寻找增量市场增长空间。面对小负载领域SCARA和高速小型六轴机器人不可避免的竞争,许多协作机器人厂商开始利用易部署、轻量化和高性价比的优势开发负载10kg以上的型号。下图整理了2022-2023新推出的协作机器人型号的负载和臂展,高负载大臂展的趋势清晰可见。

Greater openness includes different levels of openness in software and hardware. Currently, most mainstream collaborative robot manufacturers provide RDK for system integrators or customers to conduct secondary development. The growing trend towards greater openness will make a more comprehensive range of collaborative robots possible, while also enabling customized solutions to be created more effectively.

高开放度包含了软件和硬件不同层次的开放,目前大部分主流协作机器人厂商都提供RDK,可供系统集成商或者客户进行二次开发。越来越开放的趋势将使更全面的协作机器人成为可能,同时也能够更有效地创建定制解决方案。

Industry: Growth predicted for non-industrial cobot shipments in the post-pandemic era

行业:非工业占比在后疫情时代的提升可以预见

The global macroeconomic downturn in 2022 struck a significant blow to the non-industrial sector, with the penetration of collaborative robots in industries such as catering, massage, and retail (which are oriented towards individual end consumers) slowing down significantly. The impact of delays to warehousing logistics projects has also resulted in a slower growth rate than expected.

2022年全球宏观经济下行对于非工业领域带来了较大的打击,以个人为终端消费者导向的餐饮、按摩、零售等行业的协作机器人渗透明显减速。仓储物流受到项目延期的影响也增速不及预期。

In contrast, as a result of the Covid-19 pandemic, the manufacturing industry has been plagued by work stoppages and labor shortages over the past three years. The demand for upgrading and renovating production lines in traditional manufacturing industries, such as automobiles, metals and general industries, has significantly increased. Coupled with the relocation of factories or production lines by many multinational enterprises in response to supply chain adjustments, and the current trend for reshoring, demand for collaborative robots has significantly increased.

相比之下,过去三年中受到疫情影响,制造业饱受停工停产和人工短缺的困扰,以汽车、金属、一般工业为代表的传统制造业的产线升级改造需求明显增多,叠加许多跨国企业供应链调整带来的工厂或者产线的搬迁,协作机器人的需求大幅增加。

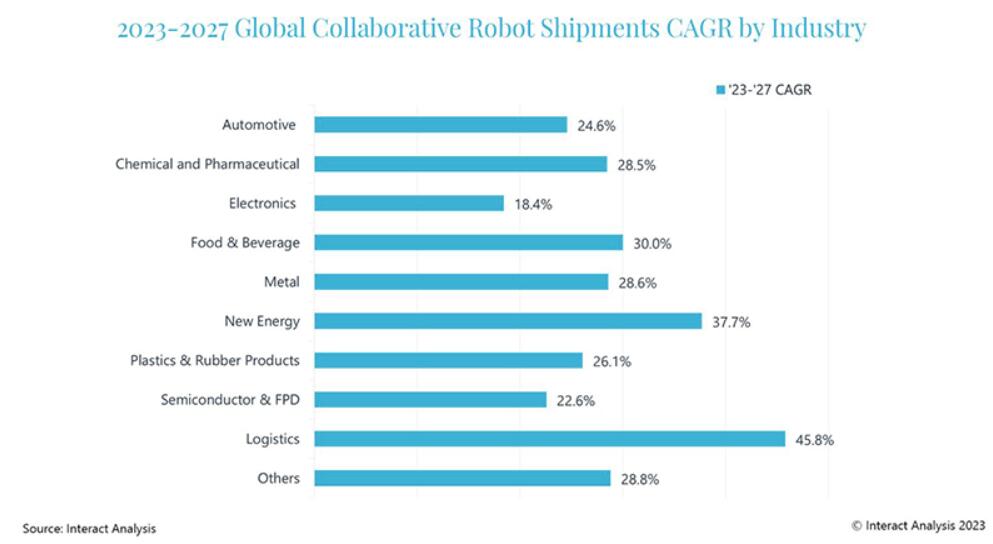

The industry with the fastest growth rate in 2022 was the new energy industry (including lithium-ion battery, wind power, PV and hydrogen), followed by automotive and electronics. This is mainly due to the accelerated growth in various parts of the new energy vehicle supply chain in 2022. Collaborative robots can quickly replace workstations due to their flexibility and ease-of-use.

2022年增速最快的行业是新能源行业(包括锂离子电池、风电、光伏和氢能),其次是汽车和电子。这主要得益于2022年新能源汽车供应链各环节的加速增长。协作机器人凭借其灵活、柔性等特点能够迅速完成工位替代。

In addition, collaborative robots have also seen relatively stable growth in industries such food & beverage, and chemicals & pharmaceuticals.

除此之外,协作机器人在食品饮料、化工医药等行业也有较为稳定的增长。

Application: Welding and palletizing emerging fast

应用:焊接和码垛异军突起

According to the Industrial Robots report from Interact Analysis, welding and material handling are the two largest applications for industrial robots. In 2022, over half of all global sales of industrial robots came from these two major applications, with the lion’s share coming from heavily loaded articulated robots. In contrast, the proportion of welding industrial robot sales was less than 5% in 2022, but with huge growth potential.

根据Interact Analysis的工业机器人报告,焊接和物料搬运是工业机器人占比最高的两大应用,2022年全球工业机器人超过一半的销售额来自这两大应用,当然主要是大负载的多关节机器人。相较而言,在协作机器人中焊接的占比在2022年仅为不到5%,增长潜力巨大。

The poor consistency of manual welding and the harsh working environment make welding a key factor in the overall efficiency of a production line, and it is also the most difficult area for many factories to recruit workers. In small factories, flexible and easily deployable collaborative robots can be used to weld small workpieces, while on large assembly lines welding of complex workpieces can also be completed by combining multiple collaborative robots or using a combination of cobots and skilled workers. Due to the high growth potential of welding scenarios, we have seen major collaborative robot companies, including UR, AUBO, and JAKA, launch specific solutions for welding applications in 2022.

人工焊接的一致性差,工作环境恶劣,使得焊接成为影响产线整体生产效率的关键因素,也是很多工厂招工最难的岗位。在小型工厂,灵活且易于部署的协作机器人可以用于焊接小型工件,而在大型流水线上,由多台协作机器人组合或者用协作机器人+熟练工人的组合,也可以完成复杂工件的焊接。正因为焊接场景的高增长潜力,我们看到包括优傲、遨博、节卡在内的主要头部协作机器人企业都在2022年针对焊接应用推出了具体的解决方案。

Collaborative palletizing has also become a hot topic, with a significant increase in the application of simple palletizing for collaborative robot arms, and a rise in loads exceeding 10kg in industries such as food & beverage and pharmaceuticals last year.

协作码垛也成为了热点话题,去年,在食品饮料,医药等行业中,负载超过10kg的协作机器人手臂的简单码垛应用出现显著上升。

Customers: Direct sales and collaboration with customers growing

客户:直接销售和与客户协作不断增长

The collaborative robots sales channel can be divided into direct sales and distribution network (through distributors or system integrators). Because most clients are small and medium-sized companies, the distribution network contributed more than 90% of total market sales before 2020. Direct sales mainly target major customers in key industries, but due to the wide coverage and geographical distribution of the robot market, relying solely on direct sales does not best meet user needs. Distributors are usually systems integrators with engineering backgrounds who provide automation solutions paired with robots for customers in different industries.

协作机分直销模式与分销模式(通过经销商或者系统集成商),早期协作机器人分销的占比超过90%。直销主要针对一些重点行业内的大客户,但由于机器人市场覆盖多且地域分布广,仅仅依靠直销并不能更好地满足用户需求;分销商通常是具有工程背景的系统集成商,它们面对不同行业的客户,提供搭配有机器人的自动化解决方案。

The distribution model can quickly build a sales network to occupy the market. However, it’s also important that robot manufacturers do not become overly reliant on the sales and technical support capabilities of distributors, and make sure they have a solid understanding of the actual needs of downstream customers. In order to have a deeper connection with customers and understand their practical application needs, the proportion of direct sales has rapidly increased over recent years, and it has become an important trend for robot manufacturers to collaborate with customers, creating different scenarios and use cases.

分销模式可以快速构建销售网络以占领市场,但同时要防止机器人厂商过分依赖分销商的销售和技术支持能力,保证对下游客户实际需求的了解。近年来,为了和客户产生更深的连结同时了解实际应用需求,直销占比迅速上升,和客户一同进行场景互创成为了重要趋势。

Direct sales enable robot manufacturers to provide suitable solutions based on the specific needs of customers, discover suitable applications for collaborative robots in a certain scenario, and work with customers to think about how best to use collaborative robots. By working closely with customers, robot manufacturers can also enhance retention rates and loyalty.

根据客户的具体需求去提供合适的解决方案,针对某个场景来发现适合协作机器人的应用然后和客户一起去思考如何使用协作机器人,这也是直销的优势。可以更好地保证客忠诚度,同时进行深入对接。

For different application scenarios, there are more suitable semi-customized products or secondary development activities that can be carried out. These methods include:

针对不同的应用场景,有更适合的半定制产品或者可以进行二次开发。方式包括:

1.Providing process packages that support rapid deployment and adaptation to certain application scenarios. Users can choose and configure kits according to their needs in order to build their own systems.

2.Providing diversified solutions for secondary development interfaces, which can quickly meet the customized needs of different industries.

3.Launch different semi-customized products for various categories of application.

1,提供支持快速部署、适配某类应用场景的工艺包,用户可以根据需求选配套件,搭建属于自己的系统;

2,对二次开发接口提供多样化方案,可以快速满足不同行业的定制化需求;

3,对不同应用大类,推出不同的半定制产品。

The future looks bright for the expanding cobot market

不断扩大的协作机器人市场前景光明

Across all the various lenses through which the worldwide collaborative robots market has been analyzed, it is clear there are signs of change and growth. We predict the market will continue to expand and adapt in response to shifting customer needs and global events.

从对全球协作机器人市场进行分析的各种角度来看,很明显存在变化和增长的迹象。我们预测市场将继续扩大和适应不断变化的客户需求和全球事件。

Strong growth is predicted in shipments through to 2027 and beyond, with price declines slowing as cobots become more intelligent and capable of carrying greater payload. While logistics applications are currently leading the market, growth is also expected in non-industrial sectors and in areas such as welding, where the full market potential has not been exploited.

预计到2027年及以后,出货量将出现强劲增长,随着协作机器人变得更加智能并能够承载更大的有效载荷,价格下降将放缓。虽然物流应用目前在市场上处于领先地位,但预计非工业部门和焊接等市场潜力尚未得到充分利用的领域也将出现增长。

In order to make the most of the potential for growth, cobot manufacturers will need to listen closely to what their customers demand and develop new application scenarios, while also working alongside distributors to build their sales networks.

为了充分实现增长潜力,协作机器人制造商需要密切倾听客户的需求并开发新的应用场景,同时还需要与分销商合作建立销售网络。

相关新闻

- ▪ 库卡挑战赛2025强势来袭,下一个获奖者就是你!

- ▪ 预见 2024:《2024 年中国工业机器人行业全景图谱》 ( 附市场规模、竞争格局和发展前景等 )

- ▪ 7亿欧元!亚马逊宣布在欧洲投资1000项机器人和人工智能驱动技术

- ▪ 中国AI大模型+人形机器人首次线下展示,李彦宏亲测!

- ▪ 到2030年,全球协作机器人市场规模将达到118亿美元

- ▪ 新松移动机器人进驻欧洲本土新能源市场,国际化征程再添里程碑

- ▪ 波士顿动力宣布,这款双足机器人退役,其后空翻曾震惊世界

- ▪ 5月15-17日│拥抱新质生产力,助力新型工业化--2024广东智博会 IARS机器人展蓄势待发!

- ▪ 一年新增10000+企业!深圳机器人“人口”爆发式增长

- ▪ 机器人企业撤回IPO申请频现