全球制造业将在2024年低迷之后于2025年复苏

http://www.gkong.com 2024-06-05 16:02 《中华工控网》翻译

Global Manufacturing Industry Recovery in 2025 to Follow Sluggish 2024

全球制造业将在2024年低迷之后于2025年复苏

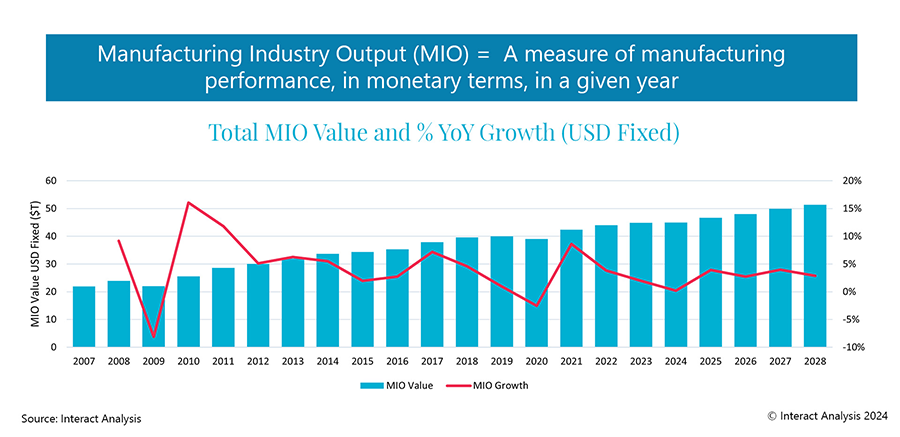

The global manufacturing economy will remain sluggish in 2024 and is forecast to expand by just 0.6% compared with last year. However, it looks set to recover in 2025, the latest data from Interact Analysis reveals. The market intelligence expert explains, except for China, most territories will experience a slight contraction this year, but many will be better off than expected going into 2025.

2024年全球制造业经济将保持低迷,预计与去年相比仅增长0.6%。不过Interact Analysis的最新数据显示,制造业经济有望在 2025 年复苏。这位市场情报专家解释说,除中国外,大多数地区今年将经历轻微萎缩,但到 2025 年,许多地区的情况将好于预期。

Although Interact Analysis has lowered growth forecasts for 2025 in its latest Manufacturing Industry Output Tracker (MIO), this is the result of a slightly improved global outlook for the end of 2024, which will in turn see most economies finish the year in a stronger position. A slight dip in the growth rate is anticipated in 2026, but manufacturing output is expected to maintain a relatively steady positive trajectory out to 2028.

尽管 Interact Analysis 在其最新的制造业产出追踪 (MIO) 中下调了 2025 年的增长预测,但由于 2024 年底全球前景略有改善,这将使大多数经济体以更强劲的地位结束这一年。预计 2026 年的增长率将略有下降,但预计制造业产出将保持相对稳定的正增长轨迹,直到 2028 年。

No clear signs of where recovery will come from

尚无明显迹象表明经济复苏将始于何处

It is still unclear where the global manufacturing recovery will come from and until there is an upturn it is difficult to judge the potential strength. Despite optimistic signs for other territories, the latest MIO includes a slight downward revision for China compared with the previous edition; from 2.8% to 2.4%. China as ‘the factory of the world’ is responsible for almost half of the total manufacturing market value and any further reductions in the country’s forecast could well lead to a small contraction in the global MIO figure for 2024.

目前尚不清楚全球制造业复苏将从何而来,在出现好转之前,很难判断潜在的实力。尽管其他地区出现了乐观迹象,但最新的制造业产出追踪与上一版相比,对中国的预测略有下调,从 2.8% 降至 2.4%。中国作为“世界工厂”,占制造业总市值的近一半,如果中国预测进一步下调,很可能会导致 2024 年全球制造业产出追踪数字小幅收缩。

Consumer resilience coupled with inflation and interest rates slowly starting to fall is pushing up spending worldwide and the US manufacturing economy is strengthening. The semiconductor industry has bounced back from a low point in 2023, boosting outlook for parts of South-Asia heavily reliant on the market sector, including Taiwan, Singapore and South Korea. Dwindling order books and the impact of the higher cost of living have constrained global demand, but there are signs of recovery in consumer spending and post-Covid supply chain problems have eased considerably.

消费者的韧性加上通胀和利率开始缓慢下降,正在推高全球支出,美国制造业经济正在增强。半导体行业已从 2023 年的低点反弹,提振了严重依赖市场部门的南亚部分地区的前景,包括台湾、新加坡和韩国。订单减少和生活成本上升的影响限制了全球需求,但有迹象表明消费者支出正在复苏,后疫情时代的供应链问题已大大缓解。

However, there are various economic indicators pointing to a more challenging environment for manufacturers. All four major European manufacturing economies are in a downward cycle, and sentiment for the year remains gloomy. Positive signals from the US may well start to manifest in other regions later in the year, but this has yet to be seen.

然而,各种经济指标表明,制造商面临的环境更具挑战性。欧洲四大制造业经济体均处于下行周期,今年的市场情绪依然低迷。美国发出的积极信号很可能在今年晚些时候开始在其他地区显现,但这还有待观察。

Conditions remain challenging for machinery market

机械市场形势依然严峻

Although the overall outlook for manufacturing is expected to improve into 2025, the machinery market is in a slightly worse position. There are variations by machinery type, but underlying factors include persistently high interest rates pushing up the price of new machinery and low order intake in the last year affecting current production figures.

尽管预计制造业的整体前景将在 2025 年有所改善,但机械市场的状况略差。机械类型各不相同,但潜在因素包括持续的高利率推高了新机械的价格,以及去年订单量低影响了当前的生产数据。

Adrian Lloyd, CEO at Interact Analysis, said, “The global outlook for manufacturing output is mixed to say the least. Our projections are holding but there are no clear signs of where recovery will come from and how strong it will be. As a result, we will be watching closely to see how constrained consumer spending in China, a strengthening US economy and global events will affect conditions.

Interact Analysis 首席执行官 Adrian Lloyd 表示:“全球制造业产出的前景至少可以说是喜忧参半。我们的预测是正确的,但没有明确的迹象表明复苏将从何而来,以及复苏的强度如何。因此,我们将密切关注中国消费支出受限、美国经济走强以及全球事件将如何影响形势。

“In the latest edition of our MIO tracker, we have added some details about machinery markets and will cover additional machinery sectors in coming editions. The machinery market appears to be experiencing more challenging conditions than manufacturing overall, as global uncertainty leads to caution around investment in equipment.”

“在我们最新版的制造业产出追踪中,我们增加了一些有关机械市场的细节,并将在未来的版本中涵盖更多机械行业。机械市场似乎比制造业整体面临更具挑战性的条件,因为全球不确定性导致人们对设备投资持谨慎态度。”

相关新闻

编辑精选

工控原创

- ▪ 美的剥离伺服资产,聚焦核心部件突围

- ▪ 六十载创新积淀,ADI开启边缘智能新篇章

- ▪ “不拥抱就下岗”!朱兴明定调汇川技术2026年:全员AI化

- ▪ 1 月工业自动化月度盘点:政策赋能 + 技术突破,开启智能制造新征程

- ▪ 汇川技术筹划赴港上市,加速国际化战略落地

- ▪ 23家新工厂跻身全球灯塔网络 制造业智能化转型加速

- ▪ 人形机器人规模化落地启幕?乐聚 Taskor 打响行业第一枪

- ▪ “人工智能+制造”怎么推进?工信部等八部门印发专项行动实施意见

- ▪ 经典焕新,实力跃升:西门子 S7-200 SMART G2 系列正式登场

- ▪ 波士顿动力发布企业级Atlas机器人,携手DeepMind赋能工业新未来